Fortunately, the authorities are onto them. The Federal Trade Commission (FTC) announced 191 law enforcement actions to crack down on timeshare-resale and travel-prize scams, including three FTC cases, 83 civil actions in 28 states, and 25 law enforcement actions in ten other countries.

All told, these swindlers bilked their victims out of tens of millions of dollars and 184 people face criminal charges so far. The FTC's announcement comes less than a year after timeshare-resale and travel-prize scams made the Consumer Federation of America's top-ten list of consumer complaints.

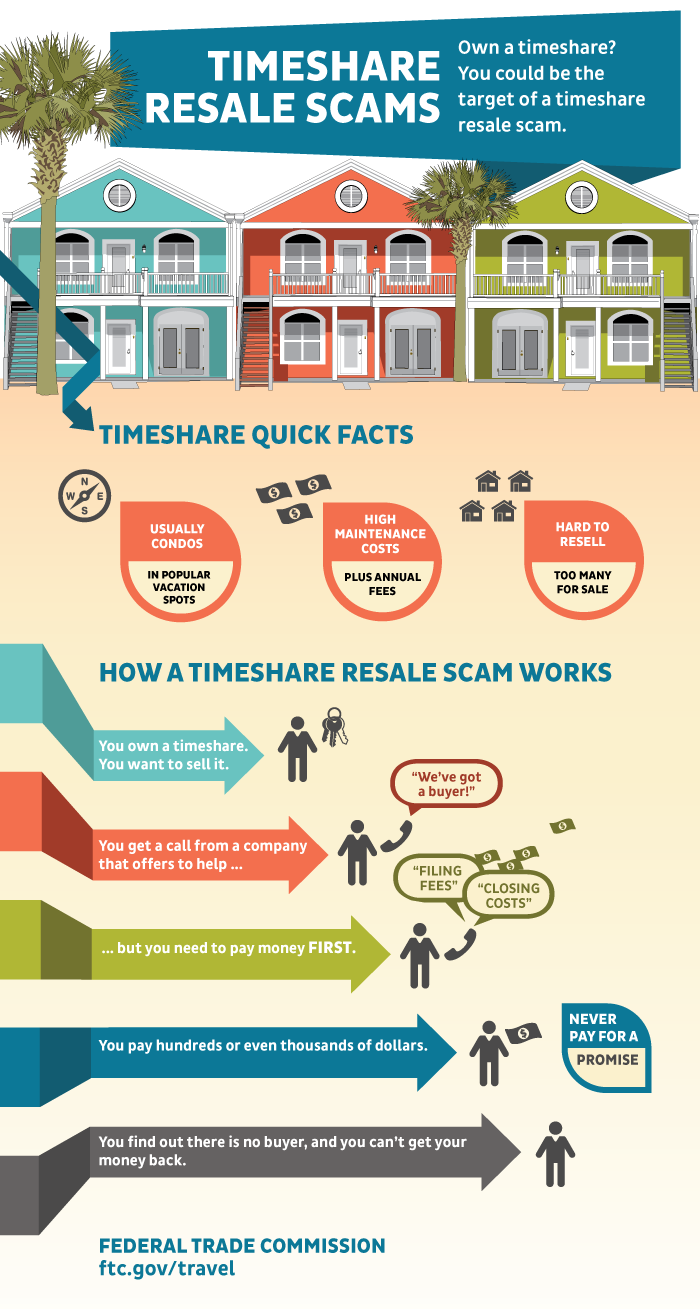

"Con artists take advantage of timeshare owners who have been in tough financial straits and are desperate to sell their timeshares," according to the agency. "They persuade owners to pay fat up-front fees by saying they have someone ready to buy the property, but that’s a lie."

Even worse, after a resale scammer has disappeared with thousands of dollars with no buyer in sight, a second con artist calls claiming to represent a "resale recovery services" firm, according to Forbes. This individual makes a false promise to recover the funds lost from the first fraudulent transaction for another hefty fee. After paying the fee, the victim never hears from them again.

The pressure may be intense for a timeshare holder, who can be on the hook for on-going maintenance fees (sometimes thousands of dollars per year) when the management companies fail to honor their contracts.

Typical travel-prize scams lure victims to high-pressure sales presentations with promises of free or discounted travel. For example, Forbes reports that Festiva promised large-screen TVs or cruises to seniors who attended Festiva sales presentations. The office of the Louisiana Attorney General, which handled scores of complaints against the company, reported that "Once there, [victims] were forced to listen to a six-hour sales pitch. Some never received their ‘prizes,’ others complained that the free cruises ended up costing hundreds of dollars in fees."

To avoid getting scammed:

- never pay for a promise and be suspicious of up-front fees (don't pay until your unit is sold, advises the FTC)

- always get everything in writing first

- have any documentation reviewed by a trusted financial advisor, realtor, or attorney before signing – if a sales rep pressures you to sign or pay something immediately, don't

- pay close attention to maintenance responsibility and rules for selling a unit

- before agreeing to anything, check for complaints against timeshare resellers by going online, or contacting the state Attorney General and local consumer protection agency